Did you know that under the veneer of trustworthiness of our beloved banks, scams lurk, waiting to prey upon unsuspecting victims? One might never suspect that Lloyds, a name synonymous with stability, can harbor a dark side. In this blog post, we will delve into the realm of Lloyds scams in the UK and shed light on real people’s stories, expose cunning tricks employed by scammers, and equip you with invaluable tips and tricks to stay safe.

Story 1: The Curious Case of Emily’s “Lucky” Phone Call

Allow me to introduce Emily, a diligent working professional who received a phone call one sunny afternoon that would turn her life upside down. A Caller ID displaying “Lloyds Bank” flashed on her screen, instilling a sense of trust. The voice on the other end assured her that her account had been compromised and requested sensitive information to rectify the situation. Unaware of the clever illusion created by scammers, Emily divulged her personal details, unknowingly opening the door to a scammer’s paradise.

Trick 1: The Illusion of Trust

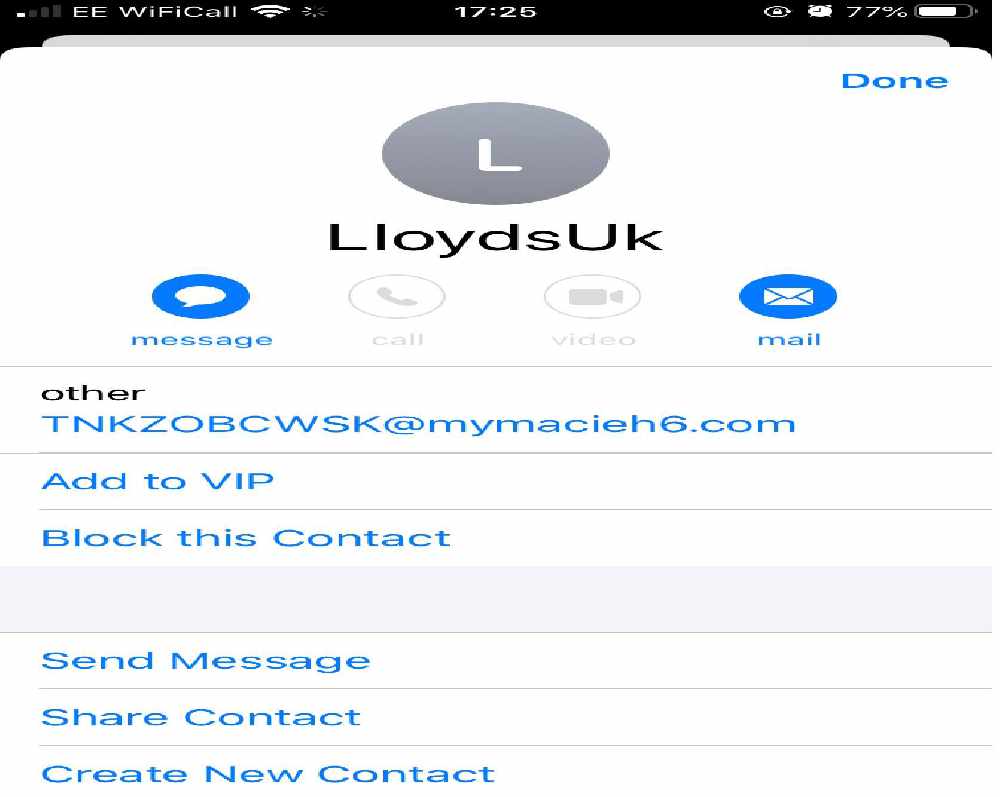

Scammers often employ various techniques to manipulate their victims. By using spoofed phone numbers or emails displaying the bank’s name, they create an illusion of trust. Remember, Lloyds Bank will never ask you to reveal your confidential information over the phone or email. Always verify the authenticity of the communication using official channels such as the bank’s website or a verified phone number.

Story 2: Mark’s Encounter with the Malicious Email

Meet Mark, a retired individual who found solace in online banking. One day, he received an email claiming to be from Lloyds, notifying him of an urgent security update required for his online banking account. The email appeared to be genuine, with logos, fonts, and even an official-looking signature. Blinded by panic and the fear of losing his hard-earned money, Mark clicked on the link, unknowingly setting the stage for a malicious attack.

Trick 2: The Art of Deception

Scammers spend countless hours perfecting their craft, replicating official bank emails to an uncanny degree. To avoid falling into their traps, ensure that email addresses are legitimate, hover over links to see if they redirect to suspicious websites, and contact Lloyds Bank directly to verify any urgent security updates.

Story 3: Sarah’s Brush with Impersonation

If you’re curious about uncovered details concerning this scam, take a look at https://whocall.co.uk/phone-number/03457302011. By reading firsthand stories and remarks from victims, you will garner a wealth of knowledge about this type of fraudulent scheme.

Enter Sarah, a conscientious entrepreneur who prided herself on being vigilant against scams. However, she encountered a situation she never anticipated. While browsing social media, Sarah stumbled upon an enticing advertisement that appeared to be from Lloyds Bank. Intrigued, she clicked on the link, only to find herself on login joker123 a sophisticated replica of Lloyds’ official website. Trusting what she thought was a genuine opportunity, she shared her personal details, unknowingly handing them to scammers on a silver platter.

Trick 3: The Temptation of Fraudulent Offers

Scammers capitalize on our curiosity and desire for a good deal, often presenting enticing offers and ads. Be cautious when encountering suspicious online advertisements, double-check the website’s legitimacy, and remember never to provide personal information unless you are entirely confident in the site’s authenticity.

Protecting Yourself: Tips, Tricks, and Vigilance

While scams may appear daunting, arming yourself with knowledge can fortify your defense against potential threats. Here are some essential tips to safeguard yourself against Lloyds scams:

1. Educate Yourself: Stay informed about the latest scam techniques and common red flags to spot fraudulent activities.

2. Verify the Source: Always double-check emails, phone calls, and websites claiming to be from Lloyds Bank.

3. Safeguard Personal Information: Never share confidential details unless you have independently verified the authenticity of the request.

4. Stay Wary of Unexpected Messages: Be cautious of unsolicited messages, especially those containing urgent or confidential requests.

5. Use Multi-Factor Authentication: Activate multi-factor authentication for extra security layers when logging into your online bank account.

Remember, vigilance is key. The fight against scammers requires a collective effort, and by staying informed and sharing this knowledge, we can protect ourselves and others from falling victim to Lloyds scams.

In conclusion, Lloyds scams in the UK can be a harrowing experience, but by understanding real people’s stories, cunning tricks employed by scammers, and implementing cautionary measures, we can ensure our financial security. Don’t let these scams overshadow the trusted institution Lloyds Bank truly is—stay safe, stay informed, and spread awareness.